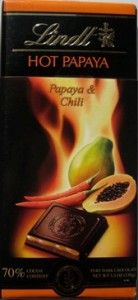

I went to a book store in a local mall the other day. As I was passing a small chocolate shop, a huge sign in front – “Store Closing – Sale 50-70% off”- caught my eye. Inside the shop, there was a commotion of people that you’d expect to see on a Valentine’s Day. It was May, not February. I didn’t have any plans to buy chocolate that day, and while I can appreciate good dark chocolate, I am not a chocoholic. The dark force pulled me into the shop nonetheless, and there I was, browsing half-empty shelves for a perfect bar of chocolate. On one of the shelves, I saw “Hot Papaya” – dark chocolate with papaya and chili peppers – only two bars left on the shelf. My hand grabbed one quickly. Leaving this massive sale with just one bar of chocolate didn’t seem right, so I picked another truffle type with soft filling and headed to the cashier.

sign in front – “Store Closing – Sale 50-70% off”- caught my eye. Inside the shop, there was a commotion of people that you’d expect to see on a Valentine’s Day. It was May, not February. I didn’t have any plans to buy chocolate that day, and while I can appreciate good dark chocolate, I am not a chocoholic. The dark force pulled me into the shop nonetheless, and there I was, browsing half-empty shelves for a perfect bar of chocolate. On one of the shelves, I saw “Hot Papaya” – dark chocolate with papaya and chili peppers – only two bars left on the shelf. My hand grabbed one quickly. Leaving this massive sale with just one bar of chocolate didn’t seem right, so I picked another truffle type with soft filling and headed to the cashier.

Most people would eat their chocolate and forget about the experience, but not me, the brain alchemist and the student of awareness. I was curious what was happening to my brain as I decided to go into the store and buy the “Hot Papaya.”

Impulse buying isn’t new, which doesn’t make it any rarer, by the way. You’d think we should know better but we fall for it all the same. There were powerful triggers at play that afternoon that lured my brain into the short-term reward, also known as “I-want-it-now” scenario.

Our brains are averse to losses, so spending money should not be easy for us. But there are caveats. The loss aversion principle works best if we deal with cash in our wallets and literally have to part with our money. When it comes to credit cards, however, paying with plastic is too abstract to trigger the areas of the brain associated with negative feelings.

On top of that, our emotional brain likes immediate rewards. The sales signs catch our attention. Bargains make us feel like we’ve won a lottery. They detract from the fact that we are spending money and, instead, emphasize the immediate gains. Instead of focusing on loss aversion, our brains are captivated by the “I-want-it-now” urge, conveniently forgetting that we didn’t plan to buy anything in the first place. It’s even more challenging to resist immediate rewards when they scream indulgence.

The brain is wired to seek pleasure. The anticipation of it is as important to the brain as actually getting what you want. Looking for a perfect chocolate bar with the highest cocoa content and fancy additions was fun. The promise of dark chocolate with a layer of papaya marmalade, infused with the heat of chili peppers, was tantalizing to my brain.

When the brain is busy searching for patterns and making predictions, it produces more neuromodulator dopamine, which is responsible for more pleasurable experience, as neuroscientist Wolfram Schultz uncovered in his famous experiment with a monkey craving apple juice. The researcher played a loud tone, waited for a few seconds, and then squirted a few drops of apple juice into the monkey’s mouth. While the monkey was waiting for the juice, the researcher monitored the response of the monkey’s brain. First, the dopamine neurons didn’t get excited until the juice was delivered. However, once the monkey learned that the tone always preceded the arrival of juice, the same neurons began firing at the sound of the tone instead of the reward. Schultz called these cells “prediction neurons” since they were more excited making predictions than receiving the rewards themselves. Schultz also discovered that when the monkey received juice without warning, a surprise reward caused even more activation in the dopamine neurons.

Were the windows of the chocolate shop with their colorful displays of chocolate in glossy wrappers enough to activate the dopamine neurons in my brain in anticipation of the rich, decadent chocolate goodness? It’s quite possible because there I was, staring at the half-empty shelves.

It turns out that you may be more inclined to buy impulsively when both your glass and the store shelf are half-empty. A shopping spree can feel especially good after a disappointing day. My trip to the chocolate shop was preceded by a visit to the dentist – not something I looked forward to. Studies show that willpower and self-control diminish when people are in a bad mood, while their search for pleasure and comfort increases. Thus, we compensate for distress by overindulging. To make things worse, people have difficulty appreciating the power of temptation and overestimate their capacity to control their own impulses. In fact, those who are the most confident about their self-control are the most likely to act impulsively.

The half empty shelf triggers the brain’s loss aversion by evoking another powerful motivator – scarcity. Nothing urges you more to buy than seeing others snatching your desired items off the shelves. In a consumer preference experiment that also involved chocolate, Stephen Worchel and colleagues offered subjects chocolate chip cookies in a jar and asked them to taste the cookies and rate their quality. One jar had ten cookies in it, and the other jar had just two. Subjects preferred the cookies from the jar of only two cookies, even though they were the same cookies. As a follow-up experiment demonstrated, the scarce cookies became even tastier when the participants watched the researcher replace a jar of ten cookies with a jar of two cookies after they were told that some of the cookies had to be given away to other participants. Seeing the cookies disappear as a result of built-up demand made them more desirable and delicious. Clearly, the brain does not want to miss out on good things that bear the stamp of approval.

Then, there is always an option of blaming your impulse purchases on priming. Most of the time, you are not even aware of its presence. Priming occurs when something in the environment activates your subconscious mind and you are more likely to act in accordance with that environment without deliberate intent. Perhaps, the chocolate shop was next to a coffee shop and my subconscious mind was reminded of a visit to a chocolate café a year before where I tasted a delicious hot chocolate drink. I did not see the connection, but my brain may have. It just didn’t bother to bring it to my attention.

The ultimate trick of the brain is that even if you know all the tricks, they still work and may trigger impulse buying. Perhaps, you let them work because too much thinking depletes willpower. An occasional chocolate indulgence may not be that bad after all. But there are other temptations out there that can have serious long-term consequences, such as sub-prime mortgages, credit card debt. Understanding the weaknesses of the brain when it comes to impulsive decision-making is important. Self-awareness is your best tool against “hot papayas” hijacking your brain.

Sources:

“How We Decide” by Jonah Lehrer

“Influence: Science and Practice” by Robert B. Cialdini

[…] This post was mentioned on Twitter by Brecht Schoeters, Brecht Schoeters. Brecht Schoeters said: In fact, those who are the most confident about their self-control are the most likely to act impulsively http://bit.ly/eYLhfg […]

This is my post on techniques to control impulse buying. See if it helps, I adopt this technique always and living debt free lifehttp://onecentatatime.com/control-spending-by-learing-to-manage-emotion/

[…] found a great article listing all of the elements at play with an impulse purchase. Getting a bargain feels good and […]